Accounting & Grant Compliance

EGC is a nationally recognized leader in providing grant accounting & compliance services to companies who have received Federal Grants and Contracts, through SBIR/STTR and other government programs. Our expertise includes establishing grant-compliant accounting systems and corporate policies; providing ongoing accounting support; fulfilling granting agency reporting requirements; advising on indirect rate negotiations; and supporting our clients through audits.

Accounting Systems Review

EGC provides a comprehensive review of companies’ accounting systems to identify areas of non-compliance and to implement strategies that will bring the client into compliance with federal regulations. We have supported companies ranging from new startups to large, multi-national publicly traded companies, in maintaining compliance with the terms of their Federal Grant Awards.

Set-Up for New Grant Awardees

Our comprehensive Set-Up for New Grant Awardees ensures that companies receiving their first Federal Award get off to a strong start in establishing the corporate infrastructure needed to properly manage their grant funding. This set-up phase includes developing a customized Accounting Policies & Procedures Manual, establishing a Project Cost Accounting System, and implementing a Timekeeping System to support the company’s grant compliance obligations.

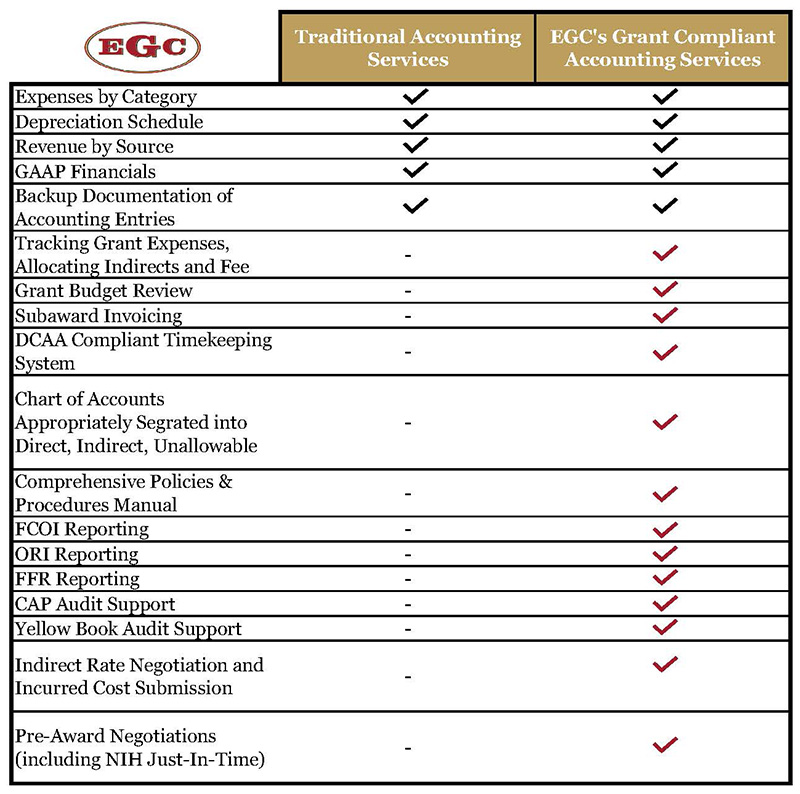

Full-Service Accounting, Financial Reporting, and Compliance Support

Our clients are able to fully outsource their accounting & compliance needs to our expert team of Grant Accountants, so that they can focus on their science. Each client works directly with one of EGC’s highly experienced Senior Leads, who is supported by our Staff Accounting Team. EGC provides a turnkey approach to all of our clients’ accounting & compliance needs by maintaining our clients’ books according to grant accounting standards; providing monthly financial reports for client management approval; coordinating with our partnering payroll companies and tax accountants; and supporting our clients’ grant reporting requirements.

Audit Support

Grant funded companies may be audited at any time, and there are certain trigger points when audits are required (for example, receiving $750K or more in Federal Government funding during your company’s fiscal year). Our team specializes in audit support for multiple types of audits, including Program Specific Audits, Single Audits, and Financial Statement Audits. Our services include preparation of required financial documentation as well as full support in addressing auditors’ questions. Our Audit Support may also be combined with our Gap Analysis (see below) as part of the pre-audit preparation process.

Indirect Rate Negotiation

Maximizing your indirect rate will ensure that your awarded funds go as far as possible to support your technology development and commercialization efforts. Our team assists clients throughout the process of determining eligibility for a rate negotiation; preparing the rate negotiation package; and communicating with auditors from Granting Agencies. Our clients are typically awarded indirect rates that are far higher than the standard amounts granted by the agencies, which can provide them with hundreds of thousands of dollars (or more) in additional funding.

“Eva Garland Consulting team is a very professional, highly integrity, responsible and considerate team. I am very impressed with their performance.”

-Reen Wu, Effector Bio

“I love the responsiveness to my specific issues and concerns. Even as an experienced grant PI, I consistently run into questions beyond my knowledge and Eva Garland has an expert regardless of the question.”

-Kevin Kallmes, Conway Medical

"I consider your service to be rated A plus.”

- Harven DeShield, PhD, Vivacelle Bio, Inc.

“Eva Garland Consulting has helped our team focus on doing science without having to worry about grants compliance. We had tried several accounting firms before EGC but none understood SBIR/STTR funding. EGC has been a godsend to us.”

- Raj Shekhar, Auscultech Dx

“Couldn't really have done any of this without the support of EGC. It is extremely appreciated. Getting into this I had no understanding of the accounting needs that a start-up would require. EGC have guided me through the whole process and ensured we stay compliant with accounting and tax requirements.”

- Stephen Duncan, Gruthan Bioscience

“Extremely helpful, courteous, and professional.”

-Eric Speck, MealMate, Inc.

“My "Go To" resource for understanding the NIH grant system”

- John Didsbury, CEO of T3D Therapeutics

“Great experience with the accounting/consulting team as timely financial information, appropriate handling procedures, and financial controls have been provided.”

- Delia DeBuc, iScreen 2 Prevent, LLC

“Aron has been extremely helpful and competent. Chris Showell is patient and has incredible expertise. I’m a grateful customer!”

-Jeanne Hahne, FaceView Mask

“Brilliant team that takes the guesswork out of grants management. Always available to help and the expert staff that represent EGC are always friendly, confident and willing to help ensure our grant success and compliance. I have been with the group for nearly 10 years and it is one of the best decisions that our company has made.”

-Anthony Dellinger, Kepley Biosystems

“I couldn’t have done this without the support of EGC since this is the first time I’ve gone through the process. The advice and support was outstanding and it’s has been a very rewarding experience working with the team.”

- Stephen Duncan, Grùthan Bioscience LLC

“Miao's ability to pivot between ad-hoc requests for support/knowledge and our monthly processes, while proactively identifying areas for improvement. I also feel like the team has our back when it comes to making us aware of any upcoming compliance changes, etc (a huge value add).”

-Sunny Dronawat, Fetal Life

“I have had the pleasure of working with Eva Garland Consulting for almost 10 years and they have consistently exceeded all of my expectations as a client. The staff at Eva Garland Consulting is simply awesome - they are friendly, professional, and always willing to go above and beyond to help their clients succeed. Eva Garland Consulting has been instrumental in my success as a federal SBIR grant recipient and start-up company. I cannot recommend Eva Garland Consulting highly enough. If you are looking for a consulting firm that truly cares about your success and will work tirelessly to help you achieve your goals, look no further than Eva Garland Consulting. They are simply the best!”

-Anthony Dellinger, Kepley Biosystems